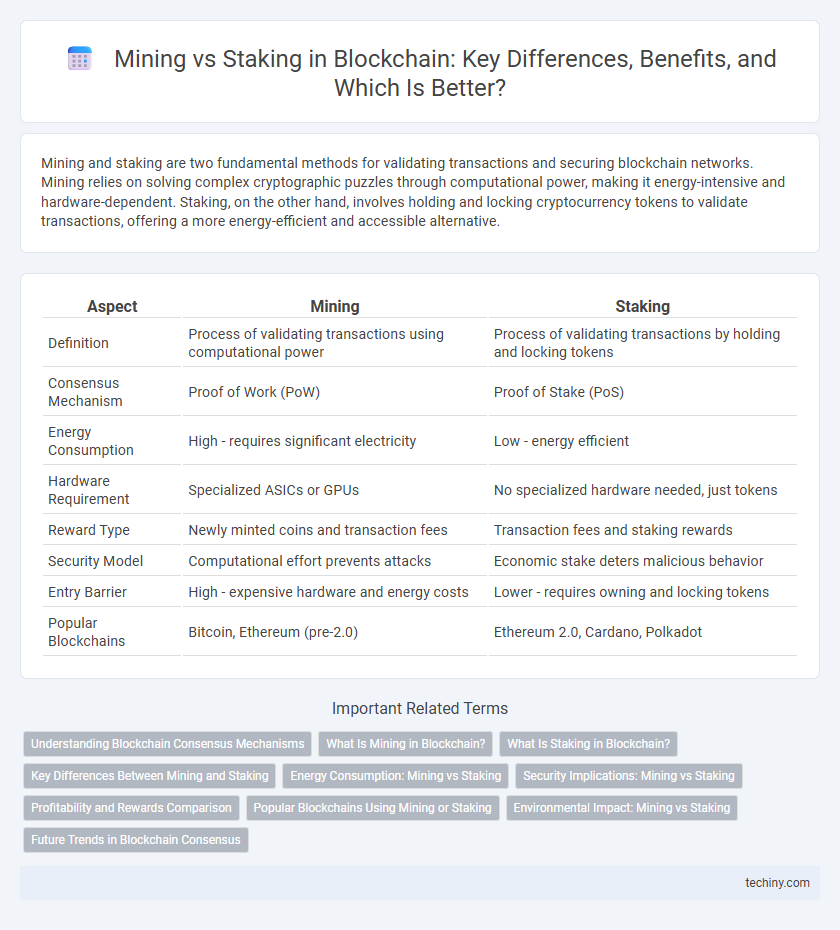

Mining and staking are two fundamental methods for validating transactions and securing blockchain networks. Mining relies on solving complex cryptographic puzzles through computational power, making it energy-intensive and hardware-dependent. Staking, on the other hand, involves holding and locking cryptocurrency tokens to validate transactions, offering a more energy-efficient and accessible alternative.

Table of Comparison

| Aspect | Mining | Staking |

|---|---|---|

| Definition | Process of validating transactions using computational power | Process of validating transactions by holding and locking tokens |

| Consensus Mechanism | Proof of Work (PoW) | Proof of Stake (PoS) |

| Energy Consumption | High - requires significant electricity | Low - energy efficient |

| Hardware Requirement | Specialized ASICs or GPUs | No specialized hardware needed, just tokens |

| Reward Type | Newly minted coins and transaction fees | Transaction fees and staking rewards |

| Security Model | Computational effort prevents attacks | Economic stake deters malicious behavior |

| Entry Barrier | High - expensive hardware and energy costs | Lower - requires owning and locking tokens |

| Popular Blockchains | Bitcoin, Ethereum (pre-2.0) | Ethereum 2.0, Cardano, Polkadot |

Understanding Blockchain Consensus Mechanisms

Mining utilizes Proof of Work (PoW) to validate transactions by solving complex cryptographic puzzles, requiring substantial computational power and energy consumption. Staking relies on Proof of Stake (PoS), where validators are chosen based on the amount of cryptocurrency they hold and lock up, promoting energy efficiency and faster transaction processing. Both consensus mechanisms ensure network security and transaction integrity but differ significantly in environmental impact and scalability.

What Is Mining in Blockchain?

Mining in blockchain refers to the process of validating and recording transactions on a decentralized ledger by solving complex cryptographic puzzles. This Proof-of-Work mechanism requires significant computational power and energy consumption to secure the network and add new blocks. Miners compete to solve these puzzles, and the first to do so receives cryptocurrency rewards, ensuring transaction integrity and network consensus.

What Is Staking in Blockchain?

Staking in blockchain involves locking up a specified amount of cryptocurrency to support network operations such as validating transactions and securing the network. Participants, known as validators or stakers, earn rewards proportionate to their staked tokens, incentivizing long-term commitment and network stability. Unlike mining, which requires significant computational power, staking relies on a consensus mechanism called Proof of Stake (PoS), making it energy-efficient and accessible.

Key Differences Between Mining and Staking

Mining involves solving complex cryptographic puzzles to validate transactions and add them to the blockchain, consuming significant computational power and energy. Staking requires holding and locking a cryptocurrency in a wallet to support network security and transaction validation, offering energy efficiency and proportional rewards based on the staked amount. Key differences include energy consumption, hardware requirements, and the mechanism by which participants earn rewards: proof-of-work for mining versus proof-of-stake for staking.

Energy Consumption: Mining vs Staking

Mining requires significant energy consumption due to complex computational processes known as Proof of Work, leading to high electricity usage and environmental concerns. Staking, based on Proof of Stake mechanisms, consumes substantially less energy by validating transactions through token ownership rather than resource-intensive computations. The energy efficiency of staking makes it a more sustainable alternative to traditional mining in blockchain consensus protocols.

Security Implications: Mining vs Staking

Mining utilizes proof-of-work (PoW) algorithms that require substantial computational power, creating energy-intensive processes with potential centralization risks due to mining pool dominance. Staking, based on proof-of-stake (PoS), leverages token holdings to validate transactions, reducing energy consumption but introducing concerns about wealth concentration and long-range attacks. Both mechanisms present distinct security implications, with mining susceptible to 51% attacks through hash rate accumulation, while staking faces risks related to validator collusion and slashing penalties.

Profitability and Rewards Comparison

Mining demands intensive computational power and high electricity costs, often resulting in substantial upfront investments but yielding block rewards and transaction fees as income. Staking requires holding a significant amount of cryptocurrency to validate transactions, offering more energy-efficient operations with rewards proportional to the staked amount and network participation. Profitability in mining fluctuates based on hardware efficiency and energy prices, while staking typically provides more predictable, albeit generally lower, returns aligned with token inflation and network incentives.

Popular Blockchains Using Mining or Staking

Bitcoin and Ethereum (pre-merge) primarily use mining through Proof of Work (PoW) to secure their networks, relying on computational power to validate transactions. In contrast, blockchains like Cardano, Polkadot, and Ethereum 2.0 utilize staking via Proof of Stake (PoS), where validators lock up tokens to participate in consensus and earn rewards. Popular blockchains adopting staking often boast lower energy consumption and faster transaction speeds compared to mining-based networks.

Environmental Impact: Mining vs Staking

Mining consumes vast amounts of electricity due to its reliance on energy-intensive proof-of-work algorithms, resulting in a significant carbon footprint. Staking operates using proof-of-stake mechanisms, which require minimal energy by validating transactions through token ownership rather than computational power. This energy efficiency makes staking a more environmentally sustainable alternative within blockchain consensus methods.

Future Trends in Blockchain Consensus

Future trends in blockchain consensus increasingly favor staking over traditional mining due to its energy efficiency and scalability benefits. Proof of Stake (PoS) mechanisms reduce carbon footprints while enabling faster transaction processing and network security enhancements. Emerging hybrid models combine PoW and PoS advantages, aiming to optimize decentralization and performance for evolving decentralized applications.

Mining vs Staking Infographic

techiny.com

techiny.com