Smart contracts automate transactions by executing predefined rules on the blockchain, enabling trustless and transparent interactions without intermediaries. Multisig wallets require multiple private keys to authorize a transaction, enhancing security by distributing control among several parties. Both tools improve blockchain security and functionality but serve distinct purposes: automation versus collective authorization.

Table of Comparison

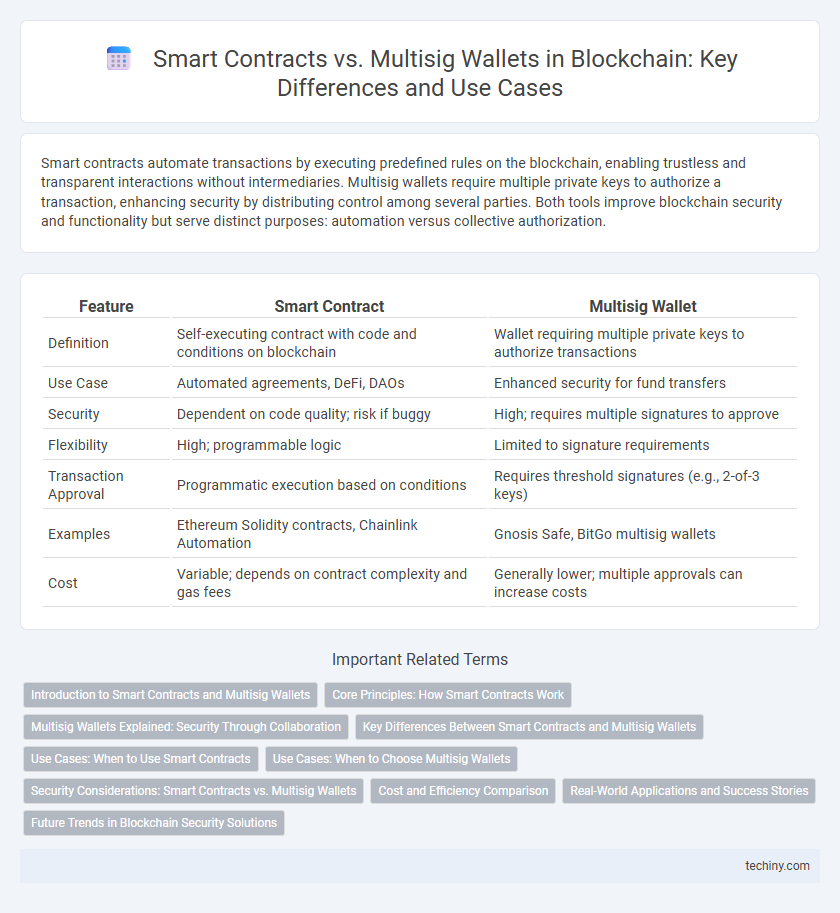

| Feature | Smart Contract | Multisig Wallet |

|---|---|---|

| Definition | Self-executing contract with code and conditions on blockchain | Wallet requiring multiple private keys to authorize transactions |

| Use Case | Automated agreements, DeFi, DAOs | Enhanced security for fund transfers |

| Security | Dependent on code quality; risk if buggy | High; requires multiple signatures to approve |

| Flexibility | High; programmable logic | Limited to signature requirements |

| Transaction Approval | Programmatic execution based on conditions | Requires threshold signatures (e.g., 2-of-3 keys) |

| Examples | Ethereum Solidity contracts, Chainlink Automation | Gnosis Safe, BitGo multisig wallets |

| Cost | Variable; depends on contract complexity and gas fees | Generally lower; multiple approvals can increase costs |

Introduction to Smart Contracts and Multisig Wallets

Smart contracts are self-executing contracts with the agreement terms directly written into code on a blockchain, enabling automated and trustless transactions. Multisig wallets require multiple private keys to authorize a transaction, increasing security by distributing control among several parties. Both technologies enhance blockchain functionality but serve different purposes: smart contracts automate agreements, while multisig wallets protect assets through collective authorization.

Core Principles: How Smart Contracts Work

Smart contracts operate as self-executing agreements with code that automatically enforces and verifies contract terms without intermediaries. They utilize blockchain technology to ensure transparency, immutability, and secure execution through predefined rules. Unlike multisig wallets, which require multiple signatures to authorize transactions, smart contracts autonomously trigger actions based on conditional logic embedded in the code.

Multisig Wallets Explained: Security Through Collaboration

Multisig wallets enhance blockchain security by requiring multiple private keys to authorize a transaction, minimizing the risk of single-point failure common in traditional wallets. Unlike smart contracts that execute programmable agreements automatically, multisig wallets focus on collaborative control, ensuring that transactions occur only with consensus from designated parties. This collective authorization process makes multisig wallets ideal for managing shared assets and safeguarding against unauthorized access.

Key Differences Between Smart Contracts and Multisig Wallets

Smart contracts are self-executing code on blockchain networks that automatically enforce agreements without intermediaries, while multisig wallets require multiple private keys to authorize a transaction, enhancing security through collective approval. Smart contracts enable complex programmable logic, such as conditional payments or automated workflows, whereas multisig wallets primarily serve as a secure method for shared control over crypto assets. Key differences include autonomy in execution for smart contracts versus human-dependent transaction approvals in multisig wallets.

Use Cases: When to Use Smart Contracts

Smart contracts are ideal for automating complex agreements that require conditional logic, such as decentralized finance (DeFi) applications, automated insurance claims, or supply chain traceability. Their programmability enables trustless, self-executing processes where actions depend on predefined rules without intermediaries. Multisig wallets, while providing enhanced security through multiple approvals, are better suited for managing shared digital assets rather than executing dynamic contractual conditions.

Use Cases: When to Choose Multisig Wallets

Multisig wallets are ideal for organizations requiring multiple approvals before executing transactions, enhancing security and reducing single points of failure. They are commonly used in corporate treasury management, decentralized autonomous organizations (DAOs), and joint accounts where collective control is essential. In contrast to smart contracts, multisig wallets provide a straightforward solution for secure asset management without complex programmable logic.

Security Considerations: Smart Contracts vs. Multisig Wallets

Smart contracts automate transactions with pre-defined rules but pose risks due to coding vulnerabilities that can be exploited, potentially leading to irreversible asset loss. Multisig wallets enhance security by requiring multiple private keys for transaction approval, reducing the risk of a single point of failure or unauthorized access. Security best practices include rigorous smart contract audits and multisig configurations to balance automation benefits with robust protection against hacks.

Cost and Efficiency Comparison

Smart contracts automate complex transactions with programmable rules, offering high efficiency but potentially incurring higher gas fees due to computational complexity on blockchain platforms like Ethereum. Multisig wallets enhance security by requiring multiple approvals for transactions, typically resulting in lower operational costs and simpler execution, though they may introduce delays in transaction approval processes. Evaluating cost-effectiveness depends on the frequency and complexity of transactions, where smart contracts suit automated, conditional scenarios and multisig wallets optimize straightforward, collaborative fund management.

Real-World Applications and Success Stories

Smart contracts automate complex agreements by executing code on blockchain platforms, widely used in decentralized finance (DeFi) for trustless lending and insurance protocols. Multisig wallets enhance security by requiring multiple approvals for transactions, protecting high-value assets in corporate treasury management and cryptocurrency exchanges. Companies like Compound leverage smart contracts for decentralized lending, while Coinbase uses multisig wallets to secure customer funds, demonstrating their pivotal roles in real-world blockchain adoption.

Future Trends in Blockchain Security Solutions

Smart contracts enhance automation and transparency by executing predefined rules without intermediaries, while multisig wallets bolster security through requiring multiple approvals for transactions, significantly reducing fraud risks. Future trends in blockchain security emphasize integrating AI-driven threat detection with multisig and smart contract frameworks to proactively identify vulnerabilities and prevent attacks. Advances in zero-knowledge proofs and decentralized identity protocols are also expected to complement these solutions, ensuring robust, privacy-preserving security in blockchain ecosystems.

Smart contract vs Multisig wallet Infographic

techiny.com

techiny.com