E-wallets and mobile wallets both provide convenient digital payment solutions for e-commerce pet purchases, enabling fast and secure transactions. E-wallets are typically accessed through web platforms and store multiple payment methods, while mobile wallets are smartphone applications designed for quick in-store or online payments using NFC or QR codes. Choosing between an e-wallet and a mobile wallet depends on user preference, device compatibility, and transaction environment for seamless pet product purchases.

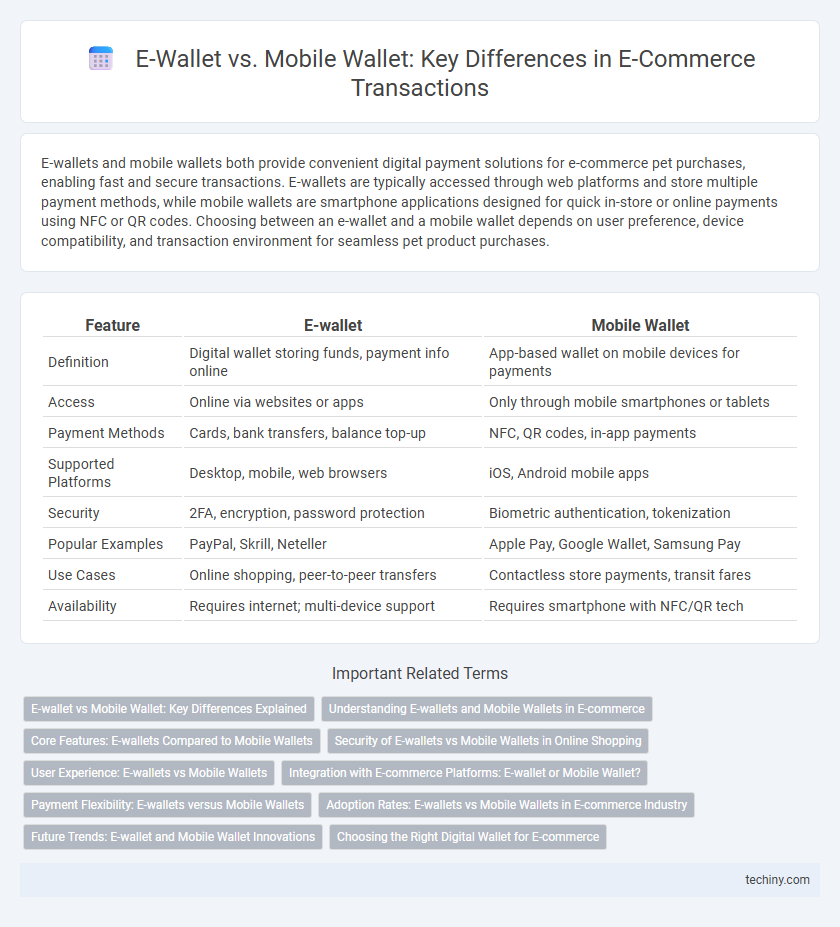

Table of Comparison

| Feature | E-wallet | Mobile Wallet |

|---|---|---|

| Definition | Digital wallet storing funds, payment info online | App-based wallet on mobile devices for payments |

| Access | Online via websites or apps | Only through mobile smartphones or tablets |

| Payment Methods | Cards, bank transfers, balance top-up | NFC, QR codes, in-app payments |

| Supported Platforms | Desktop, mobile, web browsers | iOS, Android mobile apps |

| Security | 2FA, encryption, password protection | Biometric authentication, tokenization |

| Popular Examples | PayPal, Skrill, Neteller | Apple Pay, Google Wallet, Samsung Pay |

| Use Cases | Online shopping, peer-to-peer transfers | Contactless store payments, transit fares |

| Availability | Requires internet; multi-device support | Requires smartphone with NFC/QR tech |

E-wallet vs Mobile Wallet: Key Differences Explained

E-wallets store digital versions of credit cards, debit cards, and bank accounts, enabling online and in-store payments, while mobile wallets specifically use smartphones and NFC technology for contactless transactions. E-wallets offer broad compatibility across devices and platforms, whereas mobile wallets are platform-specific, such as Apple Pay or Google Wallet. Security protocols in mobile wallets often include biometric authentication, providing enhanced protection compared to traditional e-wallets.

Understanding E-wallets and Mobile Wallets in E-commerce

E-wallets and mobile wallets serve as digital payment solutions in e-commerce, enhancing transactional efficiency and security. E-wallets store users' payment information, enabling quick checkouts across multiple devices, while mobile wallets specifically function through smartphone applications, often integrating additional features like loyalty programs and biometric authentication. Understanding the differences helps businesses optimize payment options and improve customer experience, contributing to higher conversion rates and streamlined digital commerce operations.

Core Features: E-wallets Compared to Mobile Wallets

E-wallets store payment information securely and facilitate online transactions across multiple platforms, offering features like transaction history, fund management, and multi-currency support. Mobile wallets integrate directly with smartphones, enabling contactless payments via NFC technology, loyalty rewards, and real-time alerts. Both solutions emphasize convenience and security, but mobile wallets prioritize seamless in-store usability and proximity-based transactions.

Security of E-wallets vs Mobile Wallets in Online Shopping

E-wallets employ advanced encryption protocols and multi-factor authentication to safeguard online transactions, offering robust protection against cyber threats. Mobile wallets integrate biometric security features such as fingerprint and facial recognition, enhancing user authentication during online shopping. Both e-wallets and mobile wallets continuously update security measures to combat evolving cyber risks, ensuring safe and secure payment experiences.

User Experience: E-wallets vs Mobile Wallets

E-wallets offer a seamless and secure payment experience by storing multiple payment methods and transaction histories in one platform, enhancing convenience for frequent online shoppers. Mobile wallets integrate device-specific features such as biometric authentication and NFC technology for contactless payments, providing faster and more intuitive transactions. Both solutions improve user experience but mobile wallets excel in on-the-go payments, while e-wallets deliver comprehensive management of digital finances.

Integration with E-commerce Platforms: E-wallet or Mobile Wallet?

E-wallets offer seamless integration with e-commerce platforms by supporting multiple currencies, loyalty programs, and transaction tracking, enhancing user experience and merchant efficiency. Mobile wallets, leveraging NFC and QR code technology, provide instant payment options directly from smartphones, enabling faster checkouts on both web and app-based stores. Choosing between e-wallet and mobile wallet integration depends on the target audience's device usage and the platform's compatibility requirements for secure, user-friendly payment processing.

Payment Flexibility: E-wallets versus Mobile Wallets

E-wallets offer payment flexibility by storing multiple card types and bank accounts, enabling seamless online and in-store transactions across various platforms. Mobile wallets enhance convenience through device integration, supporting contactless payments and authentication via biometrics or PIN, ensuring secure and quick checkout experiences. Both solutions provide distinct advantages, with e-wallets catering to broader financial management and mobile wallets optimizing mobility and instant payments.

Adoption Rates: E-wallets vs Mobile Wallets in E-commerce Industry

E-wallets demonstrate higher adoption rates in the e-commerce industry due to their seamless integration with online payment gateways and broad compatibility across multiple platforms. Mobile wallets, while growing rapidly, still face limitations in geographic availability and device compatibility, impacting widespread use among diverse consumer demographics. Data from recent market analyses shows e-wallet transactions constitute over 60% of digital payments in e-commerce, reflecting strong consumer trust and convenience preferences.

Future Trends: E-wallet and Mobile Wallet Innovations

E-wallet and mobile wallet innovations are set to accelerate with advancements in biometric authentication, AI-driven personalized experiences, and integration with IoT devices for seamless payments. Enhanced security protocols using blockchain technology will further protect transactions while enabling faster cross-border payments. The convergence of e-wallets and mobile wallets into unified platforms will facilitate multi-currency management and digital identity verification, shaping the future of frictionless e-commerce payments.

Choosing the Right Digital Wallet for E-commerce

E-wallets and mobile wallets are essential digital payment tools in e-commerce, offering secure, fast transactions and seamless integration with online stores. E-wallets typically support multiple payment methods and cross-platform usage, while mobile wallets are optimized for smartphone convenience and NFC payments. Choosing the right wallet depends on factors like customer preferences, payment gateway compatibility, transaction fees, and security protocols to enhance the user experience and boost conversion rates.

E-wallet vs Mobile Wallet Infographic

techiny.com

techiny.com